In the dynamic landscape of commercial For more information real estate, maximizing return on investment (ROI) demands strategic management practices. A robust strategy encompasses a multifaceted approach that includes property analysis, leasing strategies, and operational efficiency. By optimizing these elements, real estate developers can boost returns and achieve sustainable growth.

- Conducting regular market assessments to identify trends in local markets.

- Adopting smart leasing strategies that attract high-quality tenants.

- Streamlining operational processes to maximize value.

Moreover, leveraging technology and data analytics can enhance operational transparency, enabling owners to adapt to market shifts for sustainable growth.

Understanding Commercial Real Estate Agreements

Entering a commercial property leasing can sometimes feel complex and challenging. Property Owners have specific requirements and expectations, lessees need to secure favorable terms that align with their business needs. {Thorough due diligence, expert legal counsel, and a clear understanding of the lease agreement are crucial for navigating this process successfully..

- Evaluate your business requirements carefully.

- Explore commercial real estate listings.

- Discuss contract details to secure a mutually beneficial agreement.

{By following these guidelines, businesses can effectively manage their commercial leases and minimize potential risks..Ensure that your leasing strategy supports your long-term business goals.

Elevating Tenant Experience for Enhanced Property Value

A positive tenant experience isn't just about satisfaction; it directly affects your property value. Happy tenants are more likely to renew their leases, reducing vacancy costs and providing a steady revenue stream. They also become valuable advocates, drawing in new renters through positive word-of-mouth. By focusing on tenant well-being, you create a thriving community that elevates property value over time.

Propelling Sustainable Growth in Commercial Real Estate Portfolios

In the dynamic landscape of commercial real estate, investors are increasingly prioritizing sustainability. This shift is driven by a growing recognition of the influence that buildings have on the environment. To achieve sustainable growth, commercial real estate portfolios must adopt approaches that minimize their environmental footprint while also enhancing value for occupiers. Essential to this transformation is the adoption of cutting-edge technologies, such as energy-efficient building designs, renewable energy sources, and smart automation. Additionally, a focus on occupant wellness through the implementation of healthy and comfortable workspaces can substantially contribute to the long-term success of commercial real estate portfolios.

Embracing Technology for Efficient Commercial Asset Management

In today's fast-paced business environment, commercial asset management demands a strategic and progressive approach. Technology has emerged as a game-changing tool to streamline operations, enhance decision-making, and maximize performance. By implementing cutting-edge solutions, asset managers can achieve unprecedented levels of productivity and gain a competitive edge. {

A robust technology infrastructure empowers asset managers with instantaneous data visibility, enabling them to monitor portfolio performance closely. Digitalized systems can handle routine tasks such as lease management, billing, and maintenance requests, freeing up valuable time for strategic initiatives. Furthermore, sophisticated analytics tools can provide data-driven to optimize asset allocation, identify optimization opportunities, and mitigate risks effectively. By embracing technology, commercial asset managers can transform their operations into lean machines, driving sustainable growth and success in the long term.

Reducing Risk and Guaranteeing Compliance in Commercial Real Estate Operations

In the dynamic world of commercial real estate, successfully navigating the intricate web of regulations and potential liabilities is paramount. To succeed in this competitive landscape, industry players must prioritize risk control strategies while simultaneously complying with all relevant legal and regulatory frameworks. Implementing robust policies and procedures, conducting thorough due diligence, and fostering a culture of compliance are crucial steps in achieving this delicate balance.

A comprehensive risk assessment is the cornerstone upon which a successful compliance program is built. This involves pinpointing potential threats and vulnerabilities, evaluating their impact, and creating effective mitigation strategies. , Additionally, ongoing monitoring and review processes are essential to confirm that measures remain effective in the face of evolving threats and regulatory updates.

Ben Savage Then & Now!

Ben Savage Then & Now! Jeremy Miller Then & Now!

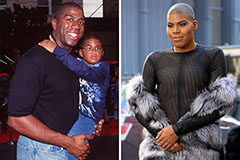

Jeremy Miller Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!